Paper Money: The OG Crypto

In the first grade, my daughter had a class project where the teacher asked what her parents did for work. I was a consultant. Most adults can’t tell you what management consultants do — forget about six-year-olds. My daughter responded, “He puts money in boxes. I’m not allowed to touch it.”

To clarify, I’m not a drug dealer, money launderer, or any of the other jobs you might associate with putting money into boxes. The “job” my daughter described is more of a hobby. I collect old U.S. paper money. I used to bring my daughter when I’d put recent acquisitions into my safe deposit box. Today, she says I’m “unemployed” since that’s easier than explaining “mostly retired.”

What does collecting old paper money have to do with crypto? More than you might expect. If you’re trying to understand where money is headed in the future, you may want to explore money from the past.

This is admittedly an odd take on crypto. I’m not expecting you to sell your Bitcoin and buy paper money. This isn’t a pump-and-dump orchestrated by a bunch of eccentric numismatists. I’m simply asking you to consider what crypto is and how it fits into the history of money.

Crypto Collectors

I don’t need to track Bitcoin. My daily conversations tell me whether the price is up or down. When prices rise, I can’t get through 24 hours without somebody mentioning crypto. When prices fall…crickets.

A few years ago, I went down the rabbit hole. Crypto market capitalization was approaching $3 trillion, and even people who couldn’t explain what a “block” was on a blockchain were preaching DeFi and Web3.

Was I missing something?

Not really. Don’t get me wrong, you can make money in crypto. Many people have — at least on paper. I only wish people would treat crypto for what it is: a collectible. It’s not an investment. It’s not money. It’s the Beanie Baby love child of tech bros and finance bros.

If you buy crypto, what do you own? Your hard-earned dollars purchase a line in a distributed ledger, certifying your stake in the future of money. As of today, $50,000 buys you a claim to one of the 21 million Bitcoins. For the price of a midsize luxury crossover, you can purchase 0.000004762% of all Bitcoins that will ever be mined.

I’m using Bitcoin as an example, but it’s not the only cryptocurrency. New coins are minted all the time. Somehow, nearly $12 billion of global capital is tied up in Dogecoin.

Collecting crypto isn’t about owning an asset. It’s about giving the middle finger to the finance industry. It’s about getting rich quickly without the social stigma of lottery tickets. It’s about imagining a future where esoteric encryption algorithms are a force for good.

In short, crypto is fueled by hopes and dreams. That kind of sounds like when we collectively decided pieces of paper were an acceptable store of value and means of exchange. On the surface, crypto is a logical next chapter in the story of money.

Money in Boxes

Is paper money a solid investment? Not really. Collectible assets tend to underperform productive assets like stocks over the long term. So why spend my present dollars on past dollars?

First, it’s rare. Not crypto rare. I mean, it’s actually rare. Many of the notes I own are one of a few dozen. In a handful of cases, my examples are nicer than those locked behind glass at the Smithsonian and Federal Reserve Banks.

Second, they’re beautiful. The funky designs, intricate details, and bold colors make them miniature works of art. I’ll share a few examples in this article, but most beautiful pieces are beyond my budget.

Finally, the stories are incredible. Crypto stories are better, but those are science fiction. Maybe they’re true, maybe they’re not. In the case of paper money, the stories are part of our national identity.

Remember when I said $50,000 can buy one Bitcoin? Let’s look at what half that amount buys in the world of paper money. Along the way, we’ll explore the revolutionaries touting crypto, whether decentralization makes sense, and what it’ll take for crypto to be the future of money.

Funding a Revolution

Before there was a United States, there were Thirteen Colonies. The people in those colonies needed to trade, but there was a problem. Gold and silver coins were in short supply. Whatever coins came into the colonies quickly flowed out in exchange for imported goods.

If you’ve ever bartered, you know it’s a pain. How many horseshoes do you want for that pig? In 1690, Massachusetts became the first colony to issue paper money. Well, sort of. They issued bills of credit payable in gold that were legal tender for the payment of taxes.

Benjamin Franklin was a fan. Here’s what he wrote in A Modest Enquiry Into the Nature and Necessity of a Paper-Currency published in 1729:

And since a Plentiful Currency will be so great a Cause of advancing this Province in Trade and Riches, and increasing the Number of its People; which tho’ it will not sensibly lessen the Inhabitant of Great Britain, will occasion a much greater Vent and Demand for their Commodities here; and allowing that the Crown is the more powerful for its Subjects increasing in Wealth and Number, I cannot think it the Interest of England to oppose us in making as great a Sum of Paper Money here, as we, who are the best Judges of our own Necessities, find convenient.

Franklin was the crypto bro of the 1700s. He wasn’t simply hyping paper money. He put his money where his mouth was…literally.

Left: Pennsylvania (1759) | Right: Maryland (1775)

Looking closely, you can see “Printed by B. Franklin” on the back of 1759 Pennsylvania notes. Paul Revere was also in the paper money business, engraving plates for Massachusetts and New Hampshire.

As July 4, 1776 approached, independence was in the air — and our currency. The front of a 1775 Maryland note features a Britannia receiving the petition of the Continental Congress as George III stomps on the Manga Carta and holds a torch to an American port. Subtle.

Paper money is inextricably linked to a story of independence. I hear similar rumblings in crypto circles. Promoters say crypto will free people from government control. It’ll allow us to move money freely and escape the tyranny of inflation.

There’s one problem. Most crypto isn’t held by people who stand to benefit most from freedom and independence. It’s not held by the Syrians escaping violence. It’s not held by the Venezuelans being crushed by inflation. It’s not held by the Rohingya people fleeing persecution.

It’s held by people like Michael Saylor. I don’t know the guy, but he seems more like George III than Benjamin Franklin or Paul Revere.

Nation of Banks

U.S. currency wasn’t always centralized. In an attempt to monetize federal debt, the government chartered more than 12,000 banks to issue paper money from 1863 to 1935. Decentralization isn’t a new idea.

Left: First Charter Note (1965) | Right: Second Charter “Brownback” (1888)

National bank notes were issued under three charters. First charter notes were primarily printed in the North since the South was still recovering from its failed revolution (and failed currency). Second charter notes were issued nationwide and included “brownbacks,” some of my favorites. Third charter notes came in various designs and sizes, including small types like the currency the U.S. government prints today.

I own a five-dollar brownback from the Fifth National Bank of Cincinnati. The bank later merged with the Third National Bank of Cincinnati to form the unimaginatively named Fifth Third Bank. I guess marketing wasn’t that important for banks in the 1920s.

Each bank used slightly different designs, including a charter number (e.g., 2798 for the Fifth National Bank of Cincinnati). Notes were initially signed by the bank President and Cashier until they got tired and started stamping their signatures.

Decentralization was a cool idea, but you might remember something terrible happening in the 1930s. National banknotes weren’t responsible for the Great Depression but fell victim to the Banking Acts of 1933 (Glass-Steagall) and 1935. It isn’t easy to stabilize a financial system when you have 12,000 banks issuing currency.

There are already more than 9,000 cryptocurrencies in the world. Do you honestly think we can shape effective fiscal and monetary policy in a system that fragmented? I don’t.

That may be why crypto is already on a path to centralization. The largest exchange, Binance, is almost ten times larger than the second-largest exchange, Coinbase. Exchanges determine who can trade and which coins people can use easily. For a currency founded on the concept of decentralization, crypto is looking more centralized every day.

Is centralization through exchanges any different than the U.S. government wrestling control of paper money? It looks similar. The difference is that the Federal Reserve has survived for 110 years. FTX barely made it three.

Form Following Function

Let’s do a thought experiment. You buy one Bitcoin. Tomorrow, Bitcoin is suddenly worthless. How do you feel? Do you take solace in your ability to confirm your Bitcoin still exists on the distributed ledger? Probably not.

If the value of my paper money goes to zero, I’ll be sad. However, I wouldn’t throw it away. In fact, I’d buy more. I’d buy 1890 Treasury Notes with their intricate “greenbacks” and 1896 Silver Certificates with their “Educational Series” motifs.

Left: Treasury Note (1890) | Right: “Educational Series” Silver Certificate (1896)

Paper money was ornate by necessity. It’s more difficult to reproduce a complex design than a simple one. Today, anti-counterfeiting features largely detract from money’s visual appeal. I’m not sure Franklin would be a fan of the obnoxious security strip uncomfortably close to his face on the current U.S. $100 bill.

Crypto takes security one step further. It doesn’t even exist in the physical world. Then again, most money today doesn’t exist in the physical world. It’s not like JPMorgan Chase & Co. is holding physical dollars on my behalf. My net worth resides in an ecosystem of encrypted databases.

Blockchain is promising, but crypto is a poorly conceived application of the technology. Crypto fails to capitalize on the best aspects of the blockchain (e.g., low cost) and makes vulnerable what should be incredibly secure (I’m looking at you, North Korea).

Crypto is a solution in search of a problem. That’s rarely a recipe for success.

Back to the Future

I’m not against financial revolutions. I’m not against decentralization. I’m not even against blockchain as a technology.

I don’t like crypto because it’s a collectible masquerading as money. It’s a simplistic solution engineered by lazy entrepreneurs to extract resources from the techno-anxious. Unlike artificial intelligence, there’s little substance behind the hype.

When and if crypto functions effectively as money, I’ll buy some. I’m not married to the U.S. dollar. We’ll look back and realize some truth existed in the crypto science fiction being spewed today.

Until then, I’ll keep collecting paper money. It’s more beautiful and rare, and it’s done something useful for the world.

If you’re passionate about crypto, you’ve probably stopped reading and are furiously typing a response along with the U.S. History buffs I’ve also offended. If you’re still reading, I have one piece of advice.

Predicting which collectible assets will appreciate long term is a fool’s errand. Collect what you like, not what you think other people will like. If you love peering into your crypto wallet, more power to you. If not, you may want to consider a new hobby.

I hear paper money is going to the moon.

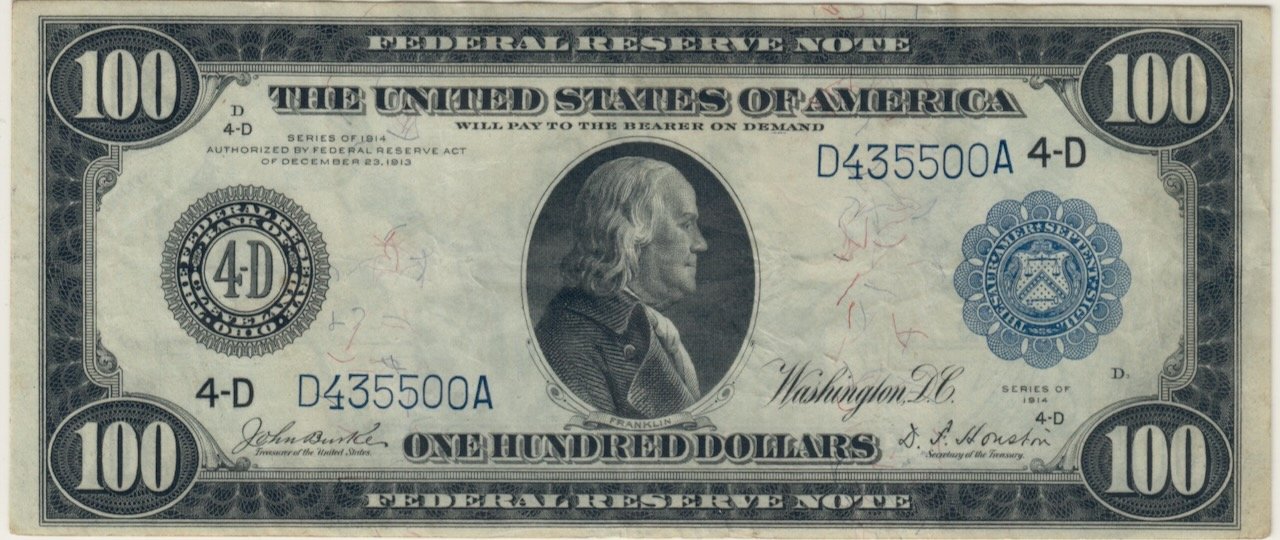

1914 note that got me interested in paper money