AI is Dead; Long Live AI!

I do my best to avoid news cycles. Most of what occupies our collective time and attention is urgent, not important. News, by its nature, is “new.” Unless you believe important events are evenly distributed through time, following the news each day is a waste of time. The important stuff will find you; you don’t need to find it.

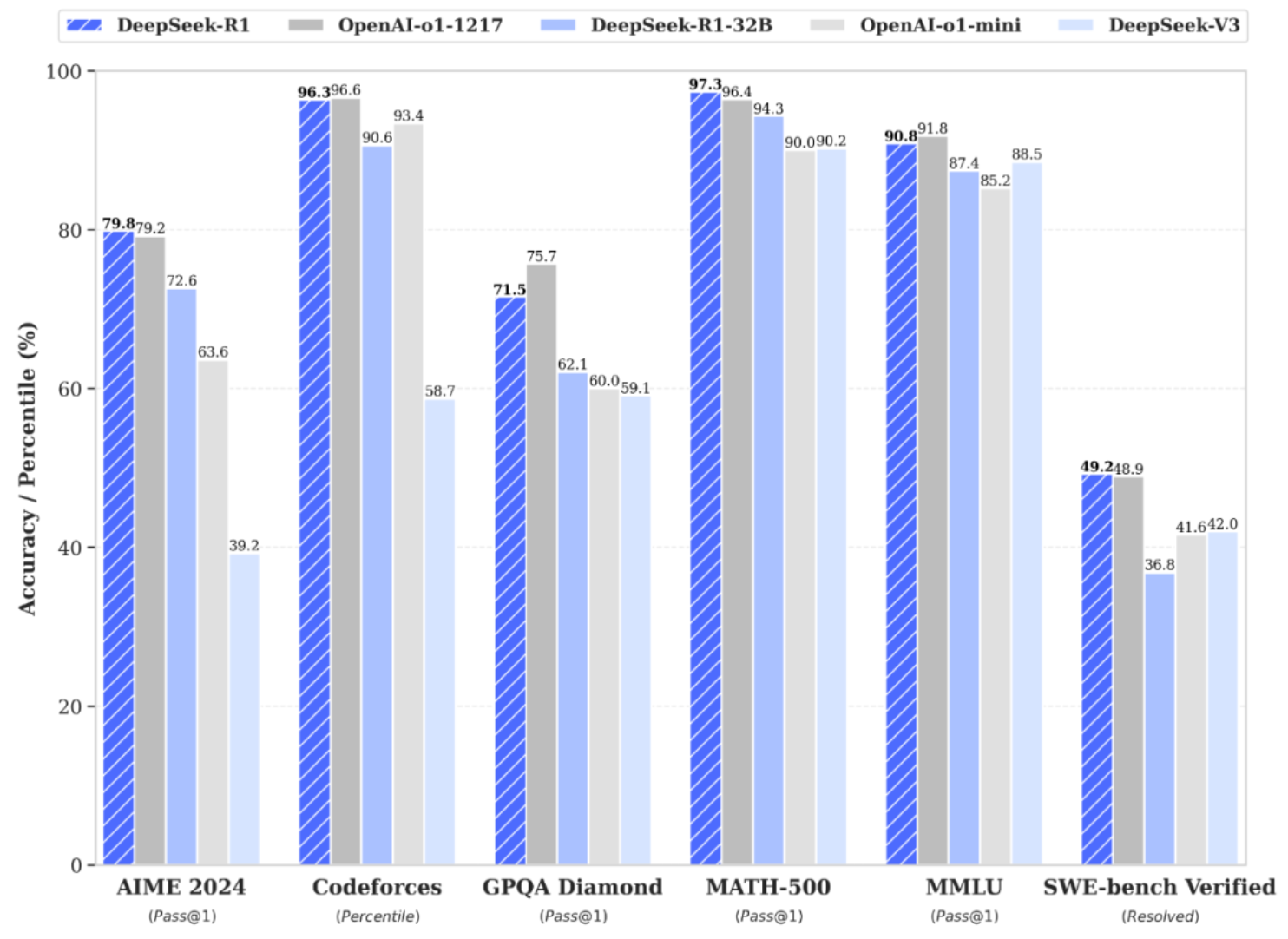

Yet, here I am writing about a technology that most people didn’t know existed a week ago. DeepSeek-R1 has jolted the AI community. People are losing their minds over a 671-billion-parameter language model from a Chinese AI company. Has the U.S. lost its lead on AI? Is this the nail in the coffin for big tech? Is this China’s “Sputnik” moment?

DeepSeek-R1 Benchmarks vs. OpenAI

Let’s all calm down. Today could indeed be a revolutionary moment for AI, but not in the way it’s being described. Experts have abandoned logic in favor of vibes. The facts tell a different story.

Not Invented Here

There’s a narrative that DeepSeek-R1 is the unintended consequence of U.S. export restrictions. By preventing China from buying chips like NVIDIA’s H100, Chinese companies invented more efficient AI models.

There are a few problems with that narrative. First, a DeepSeek technical report shows the company trained its DeepSeek-V3 model (base model for R1) on 2048 NVIDIA H800 GPUs. The H800 is less potent than the H100, but it’s no slouch. It’s not like DeepSeek was working with chips harvested from old appliances. The company had access to powerful GPUs.

Second, not everybody in the U.S. has access to H100s, either. Companies like OpenAI hoover up the advanced chips, leaving universities and smaller companies with less powerful GPUs. If necessity is the mother of invention, thousands of organizations in the U.S. are in a more constrained position than DeepSeek.

Finally, innovation is a numbers game. Anybody paying attention to AI research has seen China at the top of the publishing leaderboard. The last breakthrough of this magnitude was in 2017 when Google introduced the transformer architecture — “Attention is All You Need.” China was due for a major breakthrough.

Source: Digital Science

What would the reaction have been if DeepSeek were an EU company? I don’t remember this level of panic when Mistral launched its models in 2023. We’re still on the steep part of the AI innovation curve. We should expect breakthroughs from all the major players in the coming years.

Abandoning Ship

Perhaps more surprising than the buzz around Silicon Valley was Wall Street’s reaction. It’s easy to get caught up in the hype, but aren’t markets supposed to be rational? That’s why I have most of my money in passive index funds. I trust the market to process new information quickly, accurately, and efficiently.

So what happened today? Technology stocks dropped 3.1%, weighed down by AI companies like Nvidia (down 16.9%). I understand the hit to software companies. Perhaps the moats around companies like OpenAI, Google, and Meta aren’t as deep as they appeared last week.

I don’t understand why Nvidia’s stock took a massive hit. Let’s ignore the fact that DeepSeek trained its models on Nvidia GPUs. Future AI training will be way more efficient if the company’s claims are valid.

When the price of a good falls, demand rises. Sam Altman claims OpenAI is losing money on its $200/month ChatGPT Pro subscriptions due to high usage. Compute prices have constrained market growth. What happens when ChatGPT Pro (or an equivalent product) is $20/month? Or what about the business models that didn’t make sense when you needed 10,000 H100s but do if you “only” need 100 of them?

That’s before we talk about moving the goalposts. Why would anybody settle for a 671 billion parameter model when it’s possible to train a 20 trillion parameter model? GPT-o1 was never the end goal for OpenAI. If anything, this adds fuel to the fire for those companies pursuing artificial general intelligence (AGI).

Here’s an analogy. If gas prices decline by 80%, what will happen to Sport Utility Vehicle demand? It certainly won’t go down. So why would demand for the most power-hungry AI chips fall when energy costs decline?

In full disclosure, I purchased call options on Nvidia today. I have a horse in this race, which means I’m biased. That said, be careful about throwing the baby out with the bathwater. The disruption from DeepSeek-R1 won’t be evenly distributed.

Back to the Future

I published Artificially Human in July 2023 to help people make sense of automation and AI. The companies and products have changed, but the trends persist. If anything, the DeepSeek-R1 news means we’re still on the steep part of the exponential curve.

The R1 news also changed how I think about a few other topics I’ve written about over the past two years:

Context vs. Computation — Our contextual understanding of the world may not be better than that of machines for much longer.

AI Reasoning — I wrote this one before GPT-1o was released. We didn’t stay in the “thinking slow” era for long.

Data Assets — I hope you haven’t invested heavily in labeled data sets.

AI Safety — It might be good to figure out this whole alignment thing.

Age of Discovery — Something like a 20 trillion parameter model is what I had in mind when I wrote the final section.

In Artificially Human, I suggest updating your mental models only when important things happen. Today might be a good time to dust off your AI beliefs and ensure they still hold.

I’m open to the possibility this turns out to be a nothingburger. I’m waiting for other researchers to replicate DeepSeek’s findings, and AI adoption is still a bottleneck. Just because a better model exists doesn’t mean people will use it. Microsoft wins plenty of gunfights with a knife.

However, if DeepSeek-R1 does turn out to be significantly more efficient than existing models, buckle up! It’s going to be a wild 2025.

Disclaimer: The content of this article is provided for general informational purposes only and does not constitute investment advice, financial planning, or a recommendation to engage in any specific investment strategy. Readers are encouraged to consult a qualified financial advisor before making investment decisions.